By Durreen Shahnaz

I am often asked what motivated me to start IIX (Impact Investment Exchange Asia). My answer is a simple one: my life—where I came from and what I experienced. Like any other entrepreneur, the companies I created are extensions of my life’s defining experiences, and my attempt to find solutions and answers to the insurmountable problems I have witnessed. The 1970s and 80s for Bangladesh, my country of birth, faced an excruciating nation-building struggle mired with limited resources, national calamity, political unrest, and unending donor dependency. Throughout this time, streams of “development experts” tried to find the right path of the country, and while these efforts resulted in some much needed social outcomes, the needle of self-sufficiency hardly moved. All this translated into my very personal struggle to break the poverty cycle with new tools—tools that would bring about financial sustainability as well as meet development goals.

Thus, I embarked on a journey from the first steps of my career to utilise finance to do good for the world. This journey has now turned into a global movement that is taking the world by a storm, known as impact investing or social finance. Impact investing is now taking shape in different ways in numerous countries across the globe. While different stakeholders are slowly entering the space, the question still remains: how do we mainstream impact investing and how can we scale the movement?

Impact Investing: An Emerging Paradigm

Impact investments are investments made into companies, organisations, and funds, with the intention to generate social and environmental impact alongside a financial return. Impact investing is therefore the manifestation of two emerging trends in the development space: an increased focus on programmes that deliver sustainable value; and a desire to support collaboration between the public and private sectors. The practice of impact investing is further defined by the following four core characteristics:

• Intentionality: An investor’s intention to have a positive social or environmental impact through investments is essential to impact investing.

• Investments with return expectation: Impact investments are expected to generate a financial return on capital or at a minimum, a return of capital.

• Range of return expectation and asset classes: Impact investments target financial returns that range from belowmarket to risk-adjusted market rates, and can be made across asset classes, including but not limited to cash equivalents, fixed income, venture capital and private equity.

• Impact measurement: A hallmark of impact investing is the commitment to measure and report the social and environmental performance of underlying investments, which ensures accountability.

While impact investing aims to mobilise the supply of mission-oriented capital, it is equally important to develop the demand side of the equation. The recipients of impact investments are referred to as Impact Enterprises (IEs), and these are classified either as mission-driven for-profits (such as high-impact Small Medium Enterprises or Social Enterprises) or revenue-generating non-profits (such as NGOs that are financially sustainable). While traditional development approaches alleviate symptoms of social issues, IEs diagnose the issue and create paths to address the root causes of these problems. The growing impact investment market provides capital to IEs operating in high-impact sectors such as sustainable agriculture, clean technology, microfinance, and affordable and accessible basic services including housing, healthcare, energy, water, and education.

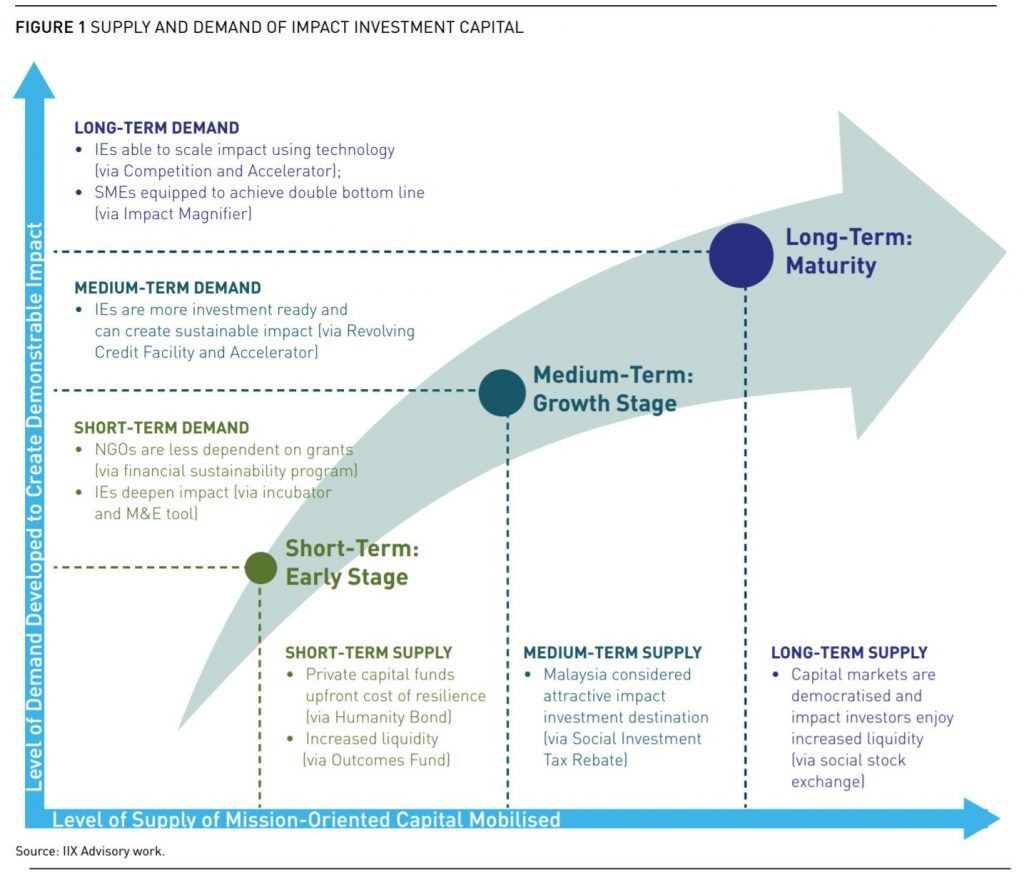

However, as the impact investment movement consolidates, several key issues have emerged. These include: scalability of enterprises, the ability of the industry to mobilise large-scale capital, and the need to have a mechanism to provide liquidity to the impact investors. Thus, along with the growth of the supply and demand of the capital, it is now time to push on innovative financing to embrace scale and innovation. Without embracing these two essential elements, it will be impossible to have effectively working social capital markets that can truly democratise capital markets. Figure 1 below demonstrates the effective supply and demand of impact investing capital that remains a key balance for sustainable growth in the impact investing space.

Asia’s Growth Irony

Over the last five decades, Asia has enjoyed one of the highest economic growth records in the world, despite a multitude of political challenges and economic shocks. With the support of global organisations such as the United Nations (UN), Asia has led the world in its drive to achieve the Millennium Development Goals (MDG): the proportion of people living on less than US$1.25 per day is projected to have fallen from 53 per cent in 1990 to 12 per cent at the end of the 2015.

However, there is still much to do to maintain the momentum for the post-2015 era. Asia is at a crossroads with many of the MDG targets still unmet. Rising inequality poses a dire threat to continued prosperity in the region, where an estimated 500 million people remain trapped in extreme poverty, most of whom comprise women and girls. The huge gap between the rich and the poor hinders holistic growth, undermines democratic institutions, and magnifies the risk of conflict—making these not just social problems, but also significant economic and political concerns. In the global context, the world has entered the age of the Anthropocene, in which the consumption of natural resources is on an unsustainable trajectory, climate change is creating irreversible damage to the environment, and the future of our planet and humanity as a whole is in question.

Traditional development players (governments, donor agencies, foundations, INGOs, among others) continue to face a funding gap, with many endemic social and environmental issues competing for a limited pool of resources. It is thus imperative to mobilise new resources that can achieve scalable and sustainable impact, and address large-scale, persistent, and emerging social and environmental problems that are straining the economy. Without creating capital markets that allow for the convergence of social progress and economic growth, Asia's ability to achieve the new Sustainable Development Goals (SDG) targets will be compromised. This mandates a need to redefine Asia’s current development narrative and rethink the way the region leverages the power of finance to generate holistic value.

Impact Investment Exchange Asia: The Regional Market Leader

Impact Investment Exchange Asia (IIX) has been at the forefront of the impact investing movement in Asia—to date impacting the lives of over 10 million people across Asia by bridging the gap between development and finance. As the regional market leader, IIX has created a robust ecosystem to effectively mobilise supply of mission-oriented capital, develop demand to absorb and deploy the capital, and bridge the gap between the two. At present, IIX is facilitating over US$40 million in impact investing capital, and has developed a network of over 30,000 ecosystem partners, including the UN, to support the eradication of poverty and create resilient nations. In addition, leveraging its expertise in innovative finance, IIX has developed a new financial product that seeks to close the current gap between development and finance: the IIX Sustainability Bond (ISB).

IIX Sustainability Bonds: An Overview

IIX Sustainability Bonds (ISBs) are innovative financial instruments that effectively mobilise largescale private-sector capital by pooling together a basket of Impact Enterprises (IEs), which include revenue-generating non-profits or mission driven for-profits and Microfinance Institutions (MFIs). Both IEs and MFIs are key drivers of change owing to their ability to create scalable impact in a financially sustainable manner. ISBs are debt securities that bring together this group of underlying borrowers (IEs and MFIs), depending on their financial needs, repayment abilities, risk profiles, and impact potential. ISBs are replicable instruments that can be structured and issued around different themes—depending on the target beneficiary (low-income women, at-risk youth, among others)— or sectors (livelihoods, energy, education, among others).

Key Objectives of IIX Sustainability Bonds

• Availability of mission-oriented capital: To open the floodgates of mission-oriented investment capital available to high-impact organisations that are equipped to create sustainable impact.

• Accessibility of mission-oriented capital: To bring together capital supply from investors with demand from high-impact organisations through an innovative, replicable financial instrument.

• Affordability of mission-oriented capital: To provide high-impact organisations access to relatively low-cost capital that is more affordable than capital available from public debt markets.

Bond Mechanism

This section provides a brief overview of the bond mechanism and how ISBs coalesce diverse stakeholders from both the public and private sectors to create an innovative new instrument that effectively unlocks private capital and redirects it towards achieving development outcomes.

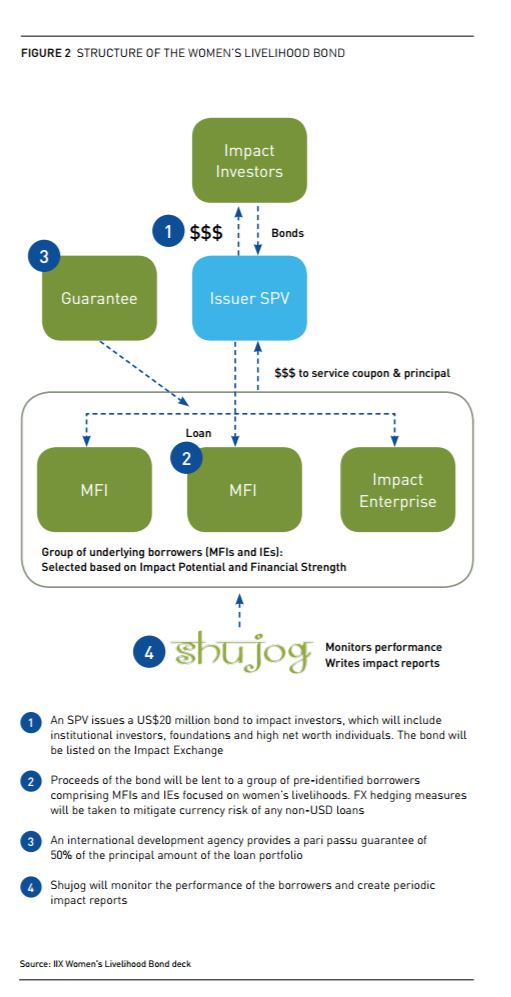

As Figure 2 demonstrates, ISBs pull together a basket (Special Purpose Vehicle, SPV) of MFIs and IEs. This basket is carefully selected so that the entities combined can maximise social and financial returns and minimises the default risk of the SPV. The bond can be further strengthened if there is a third party, usually a foundation or a donor agency, to partially guarantee the bond. A guarantee is useful because it brings more comfort to the prospective buyers (impact investors) of the bond. Once the proper due diligence is completed and the bond is structured, the banks can then sell the bond to their clients (institutional investors, high-net-worth individuals, Family offices). The ISB is the first impact investing financial instrument to be in the market that effectively addresses the need to scale both the supply and demand sides of the impact investing capital and creates liquidity, as ISBs can be publicly listed and traded). It is also forging the much needed path of establishing impact investing instruments as a new asset class.

The Women’s Livelihood Bond (WLB)

The first ISB will be the Women’s Livelihood Bond (WLB), which aims to empower women to make the transition towards sustainable livelihoods by infusing a large amount of capital through debt structuring and the public market. As an ISB, the WLB is replicable and can be customised to suit different geographic contexts from both a regulatory and needsbased standpoint. In other words, although the WLB is the first bond to focus on women’s livelihoods in Southeast Asia, it can be replicated in different geographies, sectors or focus areas. For instance, ISBs can be customised to address a region’s most pressing development issues in high-impact sectors such as sustainable agriculture, clean energy, access to education, affordable healthcare, water and sanitation, among others.

WLB’s focus is to create sustainable livelihoods for women through effective financing. Although many organisations like IEs and MFIs recognise the importance of targeting women, existing funding channels fall drastically short of development goals focused on women. The WLB sets out boldly to bridge this funding gap, by providing high-impact entities with the capital they need to support women in the most vulnerable communities today. The proceeds of the bond will be used to make loans to IEs and MFIs that are part of the sustainable livelihoods spectrum. Underlying borrowers will have a proven revenue-generating, high-impact business model.

Officially announced at the 2014 Clinton Global Initiative (CGI) annual meeting, the WLB represents IIX’s commitment to the CGI. The structuring of the WLB was funded with support from the Rockefeller Foundation and Japan Research Institute. With its focus on Southeast Asian nations, namely Cambodia, Indonesia, the Philippines and Vietnam, the WLB is making its multi-country span an even more unique feature in the world of capital markets.

IIX is anticipating a bond size of US$20 million, a tenor of four years and a target coupon rate of between six and seven per cent that will be paid to impact investors who purchase the bond. The WLB mitigates risk via credit enhancement features including a guarantee facility and an inbuilt debt service reserve account, to reduce financial risk and protect investors. For the WLB, this guarantee facility is supported by USAID (US government) and DFAT (Australian government).

Inclusivity, Customisation and Replicability

The three key features of the WLB are: inclusivity, customisation and replicability. Prior to structuring an ISB like the WLB, the impact investment intermediary structuring the bond will have to diagnose the market need and relevant value chain to assess key gaps that can be addressed by the ISB, estimate the profile of the potential pipeline of underlying borrowers, and identify regulatory constraints while designing the mechanism. This ensures that the ISB is aligned to address local needs, is designed to bring in private-sector investors from both within and beyond the region, and is well-positioned to mobilise large-scale capital to accelerate the region’s development agenda.

Innovative Financial Structuring

If the impact investing sector is going to grow, then we need a lot of innovative financial structuring. The goal of this sector is to channel large amounts of private-sector capital to the development and environment sector. But without innovative financial structuring, this goal will be unattainable. ISB needs to be the first of many such innovative financial structuring that the traditional financial industry can embrace and market.

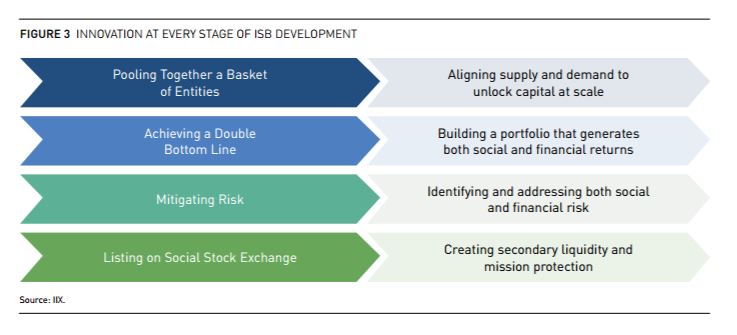

One perennial challenge for IEs is access to capital. ISBs aim to address this very issue by unlocking greater amounts of investment capital for these enterprises. By pooling high-impact enterprises into a basket of entities and incorporating various mechanisms to alleviate risk for investors, ISBs present a groundbreaking solution that overturns conventional investment approaches towards IEs. There are four innovative aspects of ISBs that, upon replication and scale, promise to bridge the “pioneer gap” facing IEs (Figure 3).

Pooling Together a Basket of Entities

The WLB will pioneer bringing the IEs and MFIs together in a single structure to allow impact investors to leverage on the strengths of both entities to mitigate risk, maximise returns, and catalyse impact. By pooling a group of underlying IEs and MFIs together, ISBs open up investment opportunities that were previously excluded, and provide a channel to attract greater amounts of impact investment capital than these entities could have otherwise accessed on their own. Additionally, the basket of borrowers consists of financially sustainable entities that are able to repay the loan amount along with interest.

Achieving a Double Bottom Line

The ISBs focus not only on unlocking large amounts of capital from new participants, but also on effectively utilising this capital to create scalable and sustainable impact. This mandates balancing social impact with financial returns throughout the bond structuring process, starting with pipeline development and continuing throughout the life of the bond.

Pre-Bond Issuance: Dual Due Diligence on Underlying Borrowers

An effective ISB requires the appropriate risk-return-impact targets of the instrument. The impact investment intermediary and the Measurement & Evaluation (M&E) partners should coordinate to conduct rigorous due diligence on potential borrowers ahead of finalising the portfolio, to assess performance on both business- and impact-related criteria.

Mitigating Risk

ISBs view risk from a dual perspective—financial risk, and mission failure or social risk. This section outlines how ISBs leverage the strength of partnerships with diverse stakeholders to adequately avoid such perils.

• Mitigating Financial Risk through Guarantee Facility Provided by Donor or Government Partner: ISBs should include a guarantee aspect, where the partnering government or donor agencies will cover a portion of the losses in case of default. This guarantee effectively improves the risk return profiles of IEs and compensates for the operational challenges that young IEs have to overcome. By incorporating aspects of blended finance, the ISBs aim to leverage on public funds from donor agencies to trigger and unlock larger amounts of private capital into the impact investment space. If borrowers do not default, the funds allocated by the guarantor can potentially be redirected for subsequent bond issues or other projects, allowing for a more efficient use of donor funding.

• Mitigating Social Risk and Linking It to Financial Risk: M&E experts should focus on pre-empting and addressing social risks during the social due diligence process by proactively identifying and finding solutions to issues that could create negative externalities, cause mission drift or in any way compromise the impact potential of the WLB. This includes governance-related issues, negative environmental impact and social issues faced by beneficiaries or employees, and so on. The ability of borrowers to use social outcomes as a way to diminish long-term financial risk deepens the sustainability of the instrument and increases the probability of success.

Listing the Bond

ISBs can be listed on a public exchange and the Bloomberg terminal. The public exchange can be a social stock exchange such as the Impact Exchange (the world’s first social stock exchange operated by the Stock Exchange of Mauritius in cooperation with IIX, regulated by the Financial Services Commission, Mauritius) or a regular public exchange which allows for the bond’s financial and social features to be showcased and reported. Listing on an exchange provides a unique opportunity for high-impact entities to raise investment capital to scale and deepen their social and environmental commitments, while offering investors a means to invest in and trade securities issued by organisations that reflect their values and can be judged on their values. Thus, this enables the creation of a liquid market—the holy grail of working capital markets.

Why Women?

It was a conscious decision to make the first ISB focus on women. Over the course of financial history, women have been excluded from the creation and operation of financial markets. However, women are at the very heart of development, and provide the underpinning of any economy.

If half of the population is underdeveloped or underutilised, an economy will never reach its full potential. Discrimination against women can hinder economic growth by essentially cutting out half the population's contributions towards a country’s demographic dividend. There is a bidirectional relationship between economic development and women’s empowerment (defined as improving the ability of women to access the constituents of development, including the resources and opportunities to participate in the labour force).

Women are at the heart of development in Asia: playing a pivotal role in supporting their households and communities in achieving food security and overall natural resource management, they are the backbone of rural enterprises, fuelling local and global economies. Research reveals that economically secure women are more likely to have healthier and better-educated children, creating a positive, virtuous cycle for the broader population. However, women around the world face four main challenges, namely:

• Poor Access to Credit and Finance: This results in vulnerability to economic shocks and stresses. By unlocking women’s access to capital, the WLB will make significant progress in creating a positive impact on women’s ability to obtain financing. Women will be able to take control of their immediate borrowing and consumption, and invest in income-generating activities or household assets. More importantly, with this initial access to credit and financial services, women can start building credit histories that can help them borrow larger amounts of capital to expand their businesses in future. There is great potential for successful women-run enterprises to create follow-on impact through employment and expanded supply chains, further providing sustainable livelihoods for more women.

• Absence of Market Linkages: This restricts women to the informal workforce. By strengthening women’s access to market linkages and educating them on available opportunities in the market, WLB borrowers can empower women to negotiate for more equitable market relations. Besides strengthening women’s bargaining positions, exposure to and integration with market-oriented models, the WLB will also enable them to identify niche areas in the market where they can capture opportunities to earn higher incomes.

• Limited Availability of Affordable Goods: This limits women’s ability to maximise productivity. By providing access to goods and services (such as education, training, basic healthcare and household goods) through low-cost instalment finance, WLB borrowers can effectively unlock purchasing power and bridge the affordability gap for female workers in developing economies. Access to this market platform can also lead to improved spending behaviour—engineering a shift away from informal borrowing and facilitating greater savings. Through the WLB, female workers will be provided with access to affordable lifeenhancing products and services to help them transition to a more economically secure and socially stable life.

• Lack of Reliable Power Supply: There is a need for women to access a cost-effective and reliable power supply in remote or rural locations. Considering the long hours they typically spend on household activities, such as cooking and running home-based micro-enterprises, improvements such as solar home systems can increase their productivity and immensely empower them. Besides the direct benefits from improved health and increased disposable incomes, women will be able to ensure a stable and sustainable environment for their families, the wider community and future generations. The social impact of these women will be measured and reported by Shujog, IIX’s sister entity that focuses on impact measurement.

Call to Action

Asian countries need strong leadership from national heads, political leaders and policymakers to create a robust impact investing ecosystem that is equipped to address development goals and empower the people at the grassroots. However, it is imperative to adopt a structured approach with clearly defined goals, customised interventions and inclusive implementation strategies. The ISB can be replicated in different countries and customised to the local context as required.

Five recommended actions are listed below that countries can implement in the short term with the objective to unlock private capital for development.

I. Replicate innovative financial instruments, such as the ISB, that are designed to mobilise large-scale capital from private-sector participants.

II. Allow for the creation of more impact investing funds that are designed to provide scalable IEs with access to capital required to magnify their impact and sustain results over the long term.

III. Optimise allocation of existing sources of mission-oriented capital to de-risk investments. For instance, governments or donor agencies can provide guarantees in order to effectively leverage resources multiple times over the committed amount, and attract significantly larger amounts of private-sector capital.

IV. Encourage linking impact-related performance with financial returns by emphasising the need for outcomes-focused models and strong focus on impact measurement and reporting, which will create greater transparency and accountability towards achieving results.

V. Coalesce diverse stakeholders and empower them to redefine the dominant development narrative through forums, conventions and conferences that promote cross-border knowledge-sharing and create a platform to catalyse South–South cooperation.

In summary, impact investing is set to revolutionise the development narrative, redefine the way capital markets create value, and position Asia at the vanguard of the global dialogue on creating resilient nations, serving as the voice of progress across the world. With impact investing ready to scale and go mainstream, we now need to have the desire to make it happen. written by Durreen Shahnaz

Durreen Shahnaz, a social entrepreneur from Bangladesh, is the founder of Impact Investment Exchange Asia (IIX), home of the world’s first social stock exchange and the largest equity crowdfunding platform for impact investing. She also founded Shujog, an impact assessment and knowledge platform for impact investing in Asia and Africa. Based in Singapore, Shujog and IIX’s work have impacted over 10 million people across Asia. Durreen has previously worked at Morgan Stanley, Grameen Bank, World Bank, Merrill Lynch, Hearst Magazines, and Reader’s Digest, as well as taught and conducted research on impact measurement and ran the Programme for Social Innovation and Change at the Lee Kuan Yew School of Public Policy at NUS. Additionally, Durreen founded, ran, and sold oneNest, a global e-marketplace for handmade goods which impacted more than half a million women globally. The 2014 recipient of the prestigious Joseph Wharton Social Impact award, her research interest focus is on scaling impact investing. She can be reached at dshahnaz@asiaiix.com

Comments